Fed funds rate has hit 2.25-2.50% marking its 4th hike this year with more increases expected through the end of 2022.

| Date | Increase | Decrease | Level (%) |

|---|---|---|---|

| July 28 | 75 | 0 | 2.25-2.50 |

| June 16 | 75 | 0 | 1.50-1.75 |

| May 5 | 50 | 0 | 0.75-1.00 |

| March 17 | 25 | 0 | 0.25-0.50 |

The Sep 13th CPI print will be an important one; June and July’s print were the same at 8.5% YoY (non seasonally adjusted), so we see a sub-8% or even a low 7% print as a slightly positive signal. A favorable print for August CPI could give the Fed a better feeling on their inflation fight, but Powell’s Jackson Hole speech was nothing short of hawkish. September’s FOMC still expects a 75 bps hike bringing the rate to 3.00-3.25, with smaller hikes in the latter months.

The target rate of 4% could have significant impacts on the federal budget; the cost to service our $30Trn of debt will skyrocket to some $900bn, or roughly 22% of the federal government’s revenues. Higher debt servicing costs forces spending cuts in other areas of the government which we know them to be sub-par capital allocators; creating problems for the economy to function properly. However, 2021’s deficit was some $300bn less than 2020’s deficit, so were trending in the right direction but still not there.

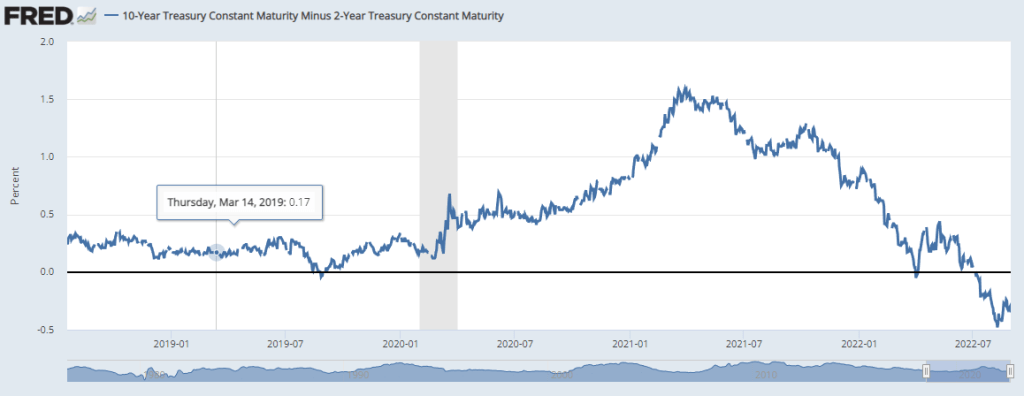

The curve is still inverted, bouncing off a low of -48bps and currently around -35bps. We at Nier Capital see the curve flattening and then normalizing over the next 14 months, into November 2023. The time of 0% rates policy is over. It was abnormal. Next year home buyers would beg for a 5% mortgage. We see the 10yr rising quickly to 525bps and the 2yr reaching 400bps over the same time horizon. A 48 bps inversion with rates at 2% is of significant proportions when compared to past events like 2008, 2000, 1980s when rates were 5%, 6%, and 14% respectively.

Oil traded as high as 130$/b earlier this year as we watched the Ukraine crisis unfold on live news. Energy independence is as important an infrastructure issue as ever. However, we see oil flattening over the next 6 months, even as we approach a cold winter. After the 130$ highs, crude traded down to mid-80s and the recent rally to mid 90s is driven by the geopolitical issues we are seeing with Nord Stream 1 and the EU grid. Oil to flatten to mid-60s per barrel will put serious pressure on destabilized nations whose main business is oil, allowing for a shift of balance in power for a possible de-escalation.

Other domestic issues on the radar include: the ever shifting midterm elections forecasts coming up in November, Jackson MS entering a profound water crisis due to years of capital misuse and under investment in city infrastructure, Biden’s plan to cancel student debt for borrowers, and the housing market beginning to show signs of serious pressure ( Jeff Weniger with a great thread).

Our portfolio at Nier Capital will begin to post quarterly returns as we manage forward looking positions. We continue to maintain a significant cash balance but have and will add to key names over the next 12 months, coupled with derivative long/short strategies to manage our total risk exposure.

We reiterate our strong long term bull theses in key names; Palantir, Unity, Stem Inc

Great read. Solid insight

LikeLike